Avoid These Submetering Contract Terms

Here's how much that "no up-front cost" contract will actually cost you.

“Leave the meters to us.”

“We take care of the financial and operational burden.”

“Turnkey 'Submetering-as-a-Service' frees you up to focus on your priorities."

Seen any of these promises? They sound so reassuring. Big "Submetering-as-a-Service" vendors (do they realize the short version of this is "Sub-aaS"?) love to make big promises about what their service will do for you while cloaking all the vital things they won't do for you.

How do we know that? Because their clients come to us when they get sick of the lack of service and the ever-growing pile of costs they're seeing. These contract terms are littered with raw deals: one-sided demands, management headaches, and so many hidden gotchas!

Here's what to watch out for.

The Top 15 Most Egregious Submetering Contract Scams

1. No early termination clause for the client

These contracts have a long initial term (usually 20 years), yet they can’t be terminated early unless both parties agree. How likely is that to happen? This is great business for them, bad business for you.

2. Payment for meters << Costs of billing services

Vendors try to make their deal sound sweet by “paying” you for the meters at the contract’s start, supposedly so you can defer some costs and make them tomorrow’s problem. They pay you a small sum up-front, and you pay them for billing services each year.

Is anyone surprised that this doesn’t work in the client’s favor? You end up paying at least 2.5X the amount you were initially paid for the meters over the life of the contract. And that's BEFORE adding in other financial obligations, like fee increases and having to buy the meters back.

Don't believe us? Let's run the numbers. If you're not into the math, feel free to skip down to the reveal.

Say you have 100 meters. At the start of the contract, the vendor pays you $70K for the meters. That's $70,000 to you.

Now for your side of the bargain: paying for billing services. You pay the vendor $13 x 100 meters x 12 months = $15,600 per year to handle billing. This is of value because it saves you time you can spend on more-valuable tenant services.

To be entirely fair to the vendor, we'll even put a dollar amount to the time this service frees up for you. The normal cost to do billing yourself is $5.50 per meter per month or $6,600 per year. So you pay $15,600 – $6,600, or $9,000 per year for the vendor to do the billing.

Over its lifetime, the contract will cost you $9,000 x 20 years = $180,000.

Compare that to the amount you received to make this deal.

$70,000 to you. $180,000 FROM you.

Does this still sound like a good deal?

3. High annual fee increases

These contracts allow “reasonable” annual increases not to exceed

CPI + 2%. At first glance, this may seem unobjectionable. Yet, the average inflation rate for the past five years was 6.36%. Are you prepared to pay an 8.36% administration fee increase each year of the contract?

Long-term contracts like these shouldn’t increase more than 2.5% per year. THAT’s reasonable.

In #2, we saw the total base costs for a 20-year contract. Now let's see how escalating fees impact those base costs. To avoid quibbles, we'll use the lower billing charge that factors in your time saved.

The cost in Year 1: $9,000

The cost in Year 5: $12,408

The cost in Year 10: $18,538

The cost in Year 20: $41,376

Total cost over 20 years at 8.36% per year: $428,654 – Just for billing!

That's 47 times larger than your first year's payment! And if the contract turns out not to save you time because of the extra management you have to put in – and believe us, you will spend a lot of time there – then the total cost to you starts at $15,600 and adds up to around $700,000. That's an average cost of $35K per year. For billing!

4. At contract's end, you have to buy back the old meters.

The client (i.e., you) must buy back the meters at the contract’s end for "the unamortized portion of the vendor's investment." Who gets to decide what that amount is? It isn't you, that's for sure.

Yes, they gave you money up front for brand-new meters. But at the end, you pay them for 20-year-old meters at a price they get to set. How much life do you think those old meters have left?

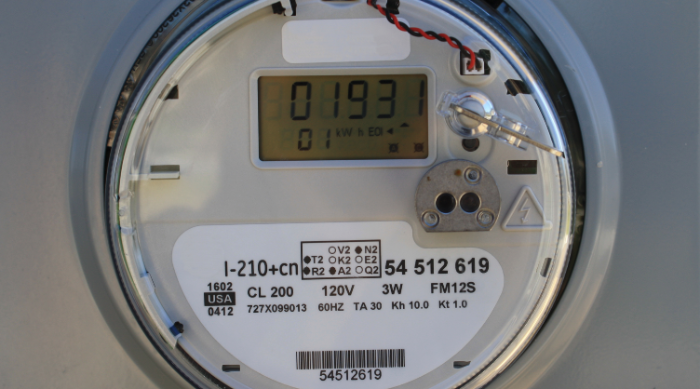

5. Meter accuracy is on your dime.

Although the vendor owns the meters, the client is responsible for the meters being installed correctly and reading accurately. Why is that on your dime and not theirs?

And if your PSC/PUC requires testing data (like our home state of NY does), you're going to have to pay extra to get that documentation. These kinds of hidden costs are typical of these conglomerate contracts.

6. You pay for replacements, but you don’t choose what gets replaced.

The submetering vendor is allowed to charge the client to replace parts of the system that don’t meet “its satisfaction.” This is an open ticket to replace any submetering component at any time and charge you for it, whether you need it or not – and whether it fixes any real problem or not.

7. You must indemnify the vendor from inaccuracies of meters you don't own and didn't install.

What the actual… The vendor owns the meters, and they agree in the contract to install and maintain the system and bill the tenants. But they won't shoulder the responsibility (or the cost – Scam #5) of ensuring their system is accurate? Nope, that legal burden is all yours.

8. The vendor's collection time frame is limited.

The vendor claims it will handle the unpleasant task of collecting non-payment. The reality is that after a set time period (often 90 days), the vendor is no longer required to do so. Once the collection requirement ends, many vendors just subtract the uncollected amount from their fees and leave it at that. Any shortfall or discrepancy is now your problem, as are any legal fees or proceedings related to collections.

9. Any cost overages are your obligation.

Compounding annual fee escalations (Scam #3) can mean that the total amount you end up paying for their Sub-aaS service comes to more than the utility provider would charge directly. The normal practice would be to pass on, or at least share, utility fees with your tenants. But, of course, it's illegal to charge a tenant more for submetering than the utility provider would charge for direct metering. To avoid illegal charges, then, you’re going to have to cover those overages yourself. So much for the vendor's claim of raising your NOI.

10. The submetering vendor retains the right to terminate the supply of electricity.

Do you really want to give them the right to turn off tenant power? We can hear the screaming now.

11. All system warranties are supposed to be transferred to the vendor for the life of the contract.

Of course, another company’s warranty is not yours to give. What does this term actually do? It gives the vendor a reason to replace a perfectly good component (as discussed in Scam 6) at your expense under the pretense of providing something under the vendor’s warranty, which happens to also lock you into the vendor’s proprietary product for its long-term gain. So sneaky.

12. You, the client, are responsible for the accuracy of all data exchanged.

We all know that move-ins and -outs aren’t that simple. How are you going to keep all tenant information correct at all times? This is just inviting headaches.

And speaking of headaches...

13. You agree to make all disclosures to your tenants.

In other words, you’re on the hook for ALL explanations. Have fun with that.

14. You shoulder the majority of the risk.

The contract will insist you have property damage liability insurance for the submetering system, yet the vendor’s liability “cannot exceed the total amounts actually paid for services giving rise to the liability for 12 months preceding the liability event.” So instead of carrying E&O insurance for the life of this contract (about $5 million), their maximum liability is going to be about $75,000. Ask them if they actually carry E&O insurance for this 20-year contract – they won’t. Overall, you’re bearing much more risk than they are.

15. The contract doesn't include an exit process for the vendor’s lack of performance.

Once you sign, you’re stuck.

Don't Accept Crappy Contract Terms

The reality is that "no up-front cost" contracts charge higher ongoing costs while providing much lower service. They don't talk about higher total costs or about how much their contracts don't cover. Plus, you’re stuck maintaining a proprietary system that you don’t own. Some contracts even charge the client every time they ask a question.

If a submetering contract sounds too good to be true, we suggest you get a second opinion on what you’re really signing up for.

Wondering how fair your contract is? We’re happy to flag terms that aren’t what they appear to be so you can make an informed decision. Contact us to understand what you'd really be paying for and for help negotiating something better.

We collected the worst of these contract scams into a fun and handy file. Check it out!

You Might Like

About utiliVisor

Your tenant submetering and energy plant optimization services are an essential part of your operation. You deserve personalized energy insights from a team that knows buildings from the inside out, applies IoT technology and is energized by providing you with accurate data and energy optimization insights. When you need experience, expertise, and service, you need utiliVisor on your side, delivering consistent energy and cost-saving strategies to you. What more can our 45+ years of experience and historical data do for you? Call utiliVisor at 212-260-4800 or visit utilivisor.com