C-PACE Financing: How It Helps Commercial Building Owners

In an unstable environment, there’s still a way to improve your building’s efficiency without a huge upfront cost.

With the leftovers of the 2020 uncertainties in our market, the standing-still-and-doing-nothing strategy will not be a winning one.

Building owners who embrace the challenge of upgrading their internal systems and provide tenants with the data that assures them of healthy building environments will survive this unstable ground.

But it's counter-intuitive to expect firms that are historically risk-averse to spending capital on these types of projects, to roll the dice suddenly.

Ask that they take an even higher risk of laying out valuable capital to implement these necessary upgrades and systems.

C-PACE financing can be your vehicle to accomplish the necessary action in an uncertain future.

Using C-PACE financing for essential improvements will assure your facility has an efficient and healthy building environment while owners keep their capital dollars.

Increase Your Building Value (and Efficiency) With Help From C-PACE Financing

Property Assessed Clean Energy ("PACE") (also referred to as C-PACE in the commercial building sector) is an innovative financing program for property owners.

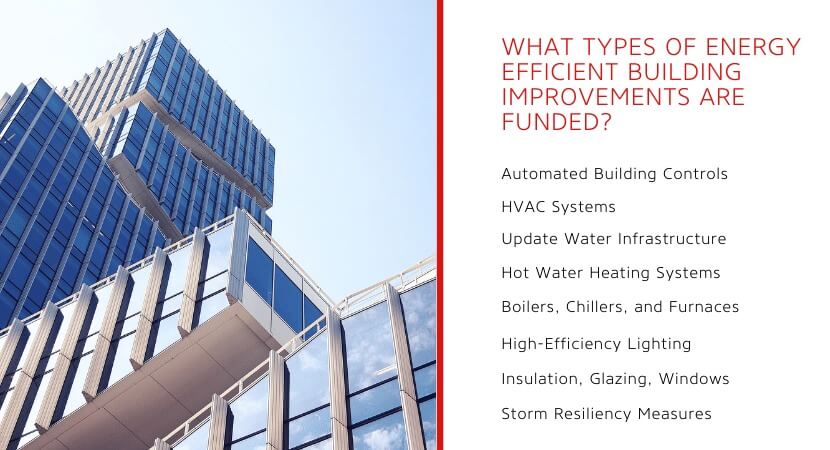

The PACE organization's vision is "to fund energy efficiency, renewable energy, water conservation, and building resiliency upgrades for all property owners."

Do you have an outdated mechanical plant that needs a complete renovation? Or are you ready to take action on energy efficiency measures to improve tenants' day-to-day lives?

C-PACE financing is making new construction, upgrades, and efficiency improvements more accessible to owners.

What (exactly) is C-PACE financing?

C-PACE helps commercial property owners and developers decrease their carbon footprint while increasing energy efficiency.

When commercial property owners increase a building's energy efficiency, they also increase the building's value and overall energy savings.

This energy savings leads to measurable dollars saved on monthly utility bills.

C-PACE offers long-term, flexible financing in thirty-seven states and Washington, D.C.

Whether you're the owner of a new or existing building, the program can make your renewable energy and efficiency projects more affordable and accessible.

Unlike traditional commercial financing, C-PACE offers eligible property owners 100% funding for the cost of qualified energy updates and improvements.

When a commercial property owner obtains funds from one of the pre-qualified private lenders, "PACE pays for 100% of the hard and soft costs of completing an energy efficiency, renewable energy, or resiliency project.

Another critical differentiator that makes C-PACE loans a low-risk option for commercial property owners is that the loans are secured by a real estate assessment on the property.

This type of loan is repaid as part of a building's real estate tax payment, which means the loan is fully assumable by any subsequent building owner.

How Owners Benefit From C-PACE Financing

-

The cost of C-PACE financing can be shared with tenants.

-

C-PACE finances 100% of the project costs.

-

Terms of up to 20 years.

-

C-PACE is property-based financing.

-

C-PACE requires no personal or corporate guarantees.

-

The obligation to repay the C-PACE financing loan transfers to the new owner when the property is sold.

Financing Energy Efficiency Projects Across The US

More cities and states continue to take bold leaps in energy efficiency legislation.

C-PACE financing offers low-risk loans that give owners the ability to reduce energy costs, increase property value, while also complying with legislation.

You Don't Have To Wait Long to See Benefits

A common misconception is that commercial property owners will have to wait a long time to see energy and cost savings.

Richard Angerame, utiliVisor's CEO with more than forty years of energy management experience, has not found this to be true:

Obtain Low-Cost, Long-Term Financing for Energy Efficient Projects

For more information on how you can utilize the C-PACE program for your energy efficiency project, click here to connect with utiliVisor.

One of our energy experts will discuss how we can help your organization obtain C-PACE financing and start stabilizing your building environments during this uncertain time.

About utiliVisor

Your tenant submetering and energy plant optimization services are an essential part of your operation. You deserve personalized energy insights from a team that knows buildings from the inside out, applies IoT technology and is energized by providing you with accurate data and energy optimization insights. When you need experience, expertise, and service, you need utiliVisor on your side, delivering consistent energy and cost-saving strategies to you. What more can our 45+ years of experience and historical data do for you? Call utiliVisor at 212-260-4800 or visit utilivisor.com